Custom Software and Offshore Development | LARION

Overview

Industry: Trading

Location: USA

Technologies we use:

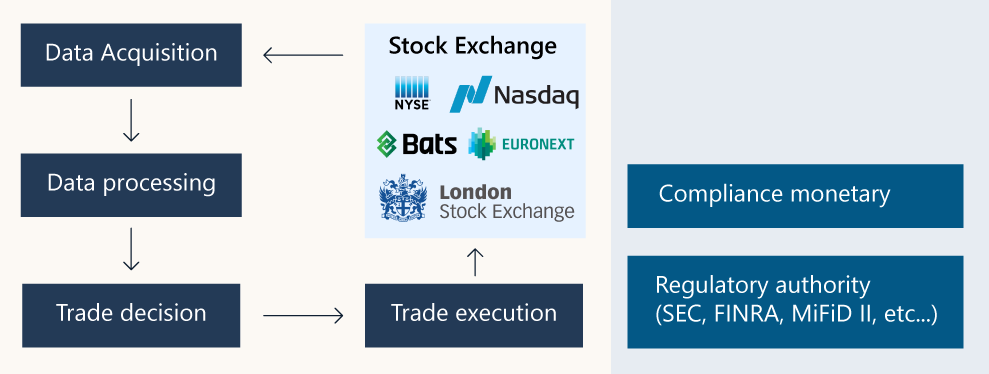

In the highly competitive field of securities arbitrage trading, LARION faced the challenge of developing a platform capable of processing vast amounts of data quickly, making informed trading decisions, and executing trades faster than competitors.

Additionally, the platform needed to interface with various stock exchanges, each with its own set of protocols and requirements.

Furthermore, the platform had to comply with a variety of regulatory standards and laws, which varied by country and region.

Solution

LARION developed a High-Frequency Trading (HFT) platform using C++. Known for its high performance and control over system resources, C++ was an ideal choice for applications that required real-time responsiveness and precision.

Connecting to Stock Exchanges

The HFT platform developed by Larion interfaces with over 30 stock exchanges, including NYSE, NASDAQ, CHX, ARCA, BATS, TSX,LSE, TSE, SSE, among others. Each of these exchanges has its own set of APIs and protocols for trading. The platform uses these APIs to connect to the exchanges and fetch real-time data.

The C++ code is optimized to handle the high-throughput, low-latency requirements of these data feeds.

Making Trading Decisions

The platform uses advanced algorithms to analyze the market data and identify profitable trading opportunities.

These algorithms are implemented in C++, taking advantage of the language’s performance characteristics to process data and make decisions quickly.

Executing Trades

Once a trading decision is made, the platform executes the trade using the appropriate exchange’s API.

The platform is designed to execute these trades as quickly as possible, with the C++ code optimized for low-latency execution.

Compliance

The platform developed by LARION complies with a variety of regulatory standards and laws, which can vary by country and region. In the United States, it complies with regulations set forth by the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

In the European Union, it complies with the Markets in Financial Instruments Directive (MiFID II). As the platform also operates in Japan and China, it complies with the relevant securities regulations in these countries.